Three Main Criteria for Homebuyer Selection

NEED: for simple, safe, decent and affordable housing as defined by, but not limited to one or more below:

- Substandard living conditions

- Unsafe living environment Cost Burdened

- Overcrowded (adult and child or more than two children share a bedroom, or two children of the opposite sex share a bedroom)

- Government Subsidized Housing

ABILITY TO PAY: up to a 30-year, interest free mortgage:

- No unpaid debts, collections, liens or outstanding judgements

- Habitat mortgage loans require a minimum down payment of $1,000 and first-years homeowners insurance premium

- At least 2 years of continuous, steady and verifiable income

WILLINGNESS TO PARTNER: with HFH of Henderson

- Complete a minimum of 250 hours of "Sweat Equity" (your time instead of cash - on your home, other Habitat homes, our ReStore, Affiliate office, fundraisers and other types of approved community volunteer opportunities

- *Media coverage is critical to securing funding needed for future Habitat homes. Families may be photographed at events or while putting in sweat equity hours and could appear on any of the news outlets, HFHH website or social media outlets during and after their partnership participation.

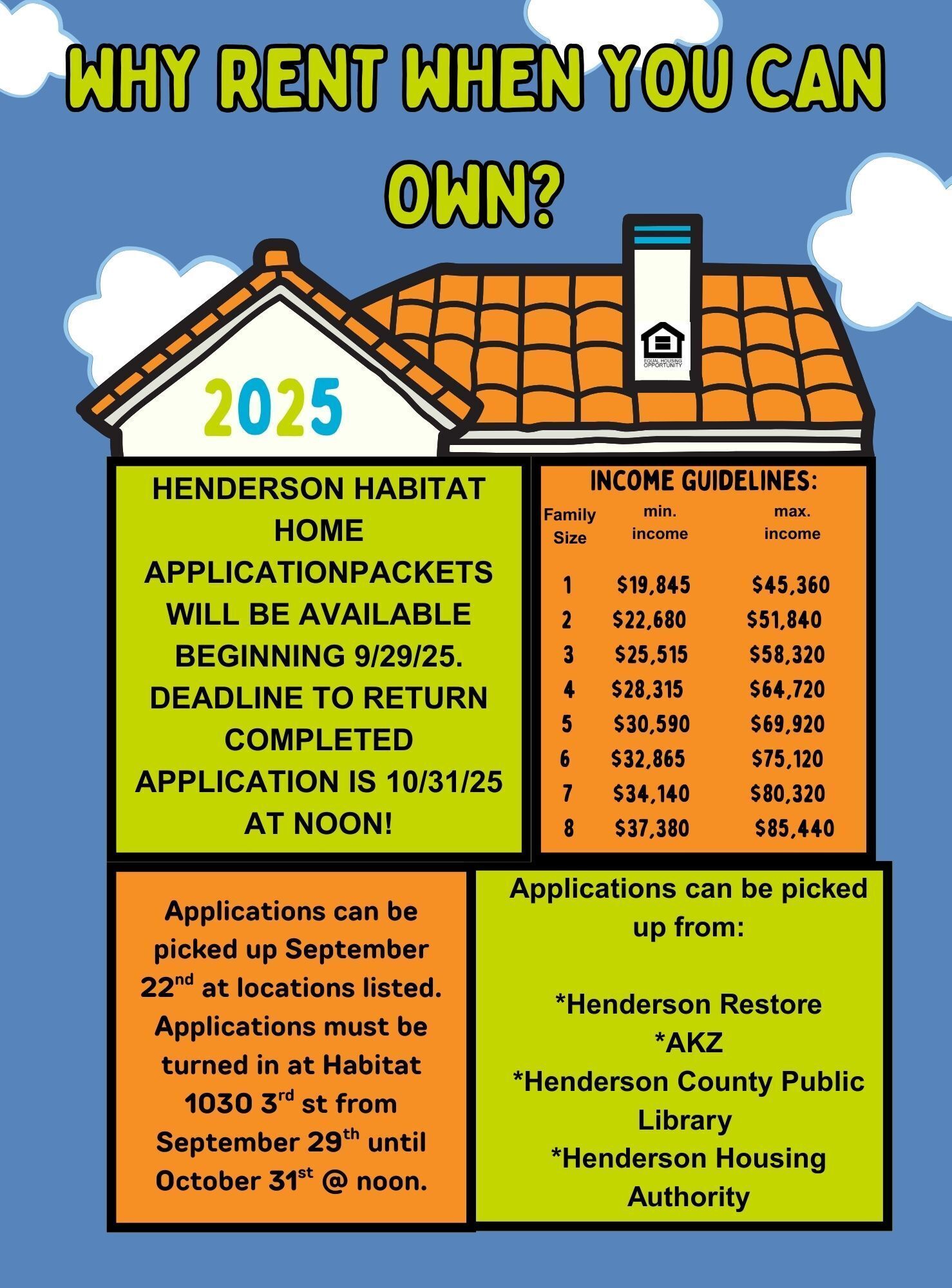

| 1. | $19,845 | $45,360 |

| 2. | $22,680 | $51,840 |

| 3. | $25,515 | $58,320 |

| 4. | $28,315 | $64,720 |

| 5. | $30,590 | $69,920 |

| 6. | $32,865 | $75,120 |

| 7. | $35,140 | $80,320 |

| 8. | $37,380 | $85,440 |

-

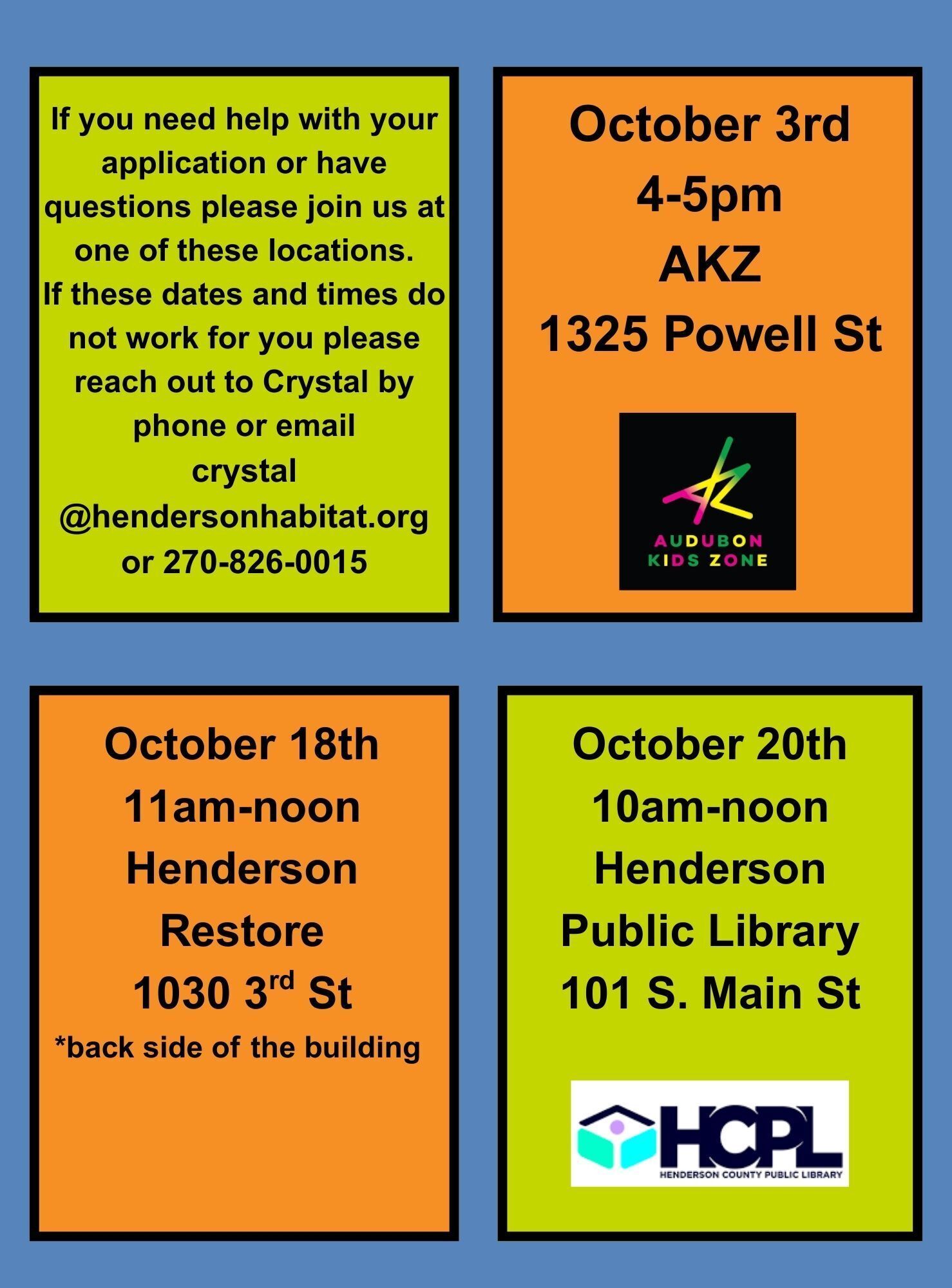

Habitat Home application packets for our Homeownership Program will begin accepting applications again in October of 2026. Follow us on our Facebook pages for updates later this year. If you have any questions regarding application criteria, please email crystal@hendersonhabitat.org

-

Our Home Partnership Program is Currently Full

We are thrilled to share that our Home Partnership Program has reached capacity for the current cycle! Our partner families are actively earning their required “Sweat Equity” hours through a variety of activities—including attending homeownership and financial literacy classes, working on build sites, volunteering at the ReStore, helping at community events, and more.

This year, we’re working with more families than ever before, and the excitement is building as we move closer to celebrating Henderson Habitat’s 100th home—a major milestone we expect to reach within the next 18 months!

📅 Stay tuned! We’ll announce the next open application period for our Home Partnership Program on our Facebook page. Be sure to follow us so you don’t miss your opportunity to apply!

-

Housing Applications

Housing Applications

If you would like more information about the program and how you can prepare for the process and receive a reminder for the next application sessions, please email crystal@hendersonhabitat.org